Windletter #126 – Big onshore contracts for Western manufacturers

Also: SGRE intends to commercialise the SG21.5-276, why Chinese offshore turbines don’t have a helipad, carrying out a short-circuit test on a full wind farm, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

Most read in the previous edition: the evolution of wind turbine size, the spectacularly cheap PPAs in Saudi Arabia, and the repair of a Vestas V162 spinner.

Last week we also published:

The story of Nabrawind on its tenth anniversary. A truly inspiring feature worth reading. Read it here.

The exclusive on Tetrace’s merger with Magma and the incorporation of Enhol as shareholder. Read it here.

Let’s go with the last news edition of the year.

💼 Western OEMs end the year with major onshore contracts signed

2025 has been the year in which, finally, Western manufacturers, with Nordex and Vestas leading the way, seem to be lifting their heads after a long and deep crisis. And they have wanted to (or rather, have been able to) close the calendar year by announcing several large-scale onshore contracts.

Nordex

The Spanish-German manufacturer recently announced an agreement with Alliant Energy in the United States for the supply of up to 190 turbines of the N133 and N163 Delta4000 models. Installation is planned for 2028 and 2029 and, once in operation, the wind farm will reach up to 1,060 MW of installed capacity.

We are talking about a volume rarely seen in the current market. Although it is important to note that Nordex mentions “up to” 190 turbines, so the final number could be lower.

This contract is a clear backing for the reopening of Nordex’s factory in West Branch (Iowa), where production of hubs, gearboxes and nacelles has recently resumed. In fact, it is the largest contract in Nordex’s 25-year history in the United States.

Vestas

The Danish company, for its part, closed the year with a 828 MW contract in Brazil, which includes the installation of 184 units of the V150-4.5 MW model. This platform has been Vestas’s real best-seller for years and, although in some markets it is starting to be replaced by the EnVentus platform (V162, V172 in 6.X and 7.X ratings), it still enjoys excellent commercial health.

The agreement is especially relevant because it strengthens Vestas’s position in Brazil, a market where Chinese OEMs have entered strongly, led by MingYang and Goldwind. The latter also has a local nacelle assembly plant.

In addition, although this was signed some time ago, Vestas has recently started installing 38 EnVentus V172-7.2 MW turbines in Portugal, totaling 274 MW in what will be the country’s largest wind farm and probably the largest in the Iberian Peninsula. The Tâmega project is especially unique due to its hybrid nature, being integrated with a pumped-storage hydroelectric plant, as previously reported in Windletter.

Siemens Gamesa

Siemens Gamesa is still suffering the effects of the commercial halt of its onshore 4.X and 5.X platforms (now rebranded as 5.0 and 7.0). The first orders after its return to the market are still trickling in, although all signs suggest it should start gaining traction throughout 2026.

Where there has been some recent movement is in the sale of the NIAT project, 500 MW in Egypt, to Alcazar Energy Partners. Note: this refers to the sale of the development, not the turbine supply contract, which is not yet signed, although under negotiation.

As we reported in Windletter, all signs point to the project being equipped with 100 units of the SG5.0 (2.0), probably with a 132-meter rotor. If confirmed, it would be a very significant milestone for Siemens Gamesa and its return to onshore.

Egypt has historically been a key market for the company, with more than 1.5 GW installed, especially with 2 to 3 MW turbines. However, it is also a market where Chinese OEMs are already well-positioned. Goldwind has a 500 MW wind farm in operation with its GW165-6.0 MW model, later expanded with 20 units of 7.5 MW, while Envision recently announced a 1.1 GW contract in the country.

GE Vernova

The American OEM has also ended the year with very good news, especially in the Romanian market. Between October and December, GE Vernova announced the sale of 107 turbines of its 6.1 MW and 158-meter model, amounting to a total of 652.7 MW.

Romania has become one of the most active onshore markets in Europe, with sizeable auctions, and had been dominated by Vestas in recent years. These contracts confirm that competition is heating up again in Eastern Europe.

Ørsted turns its silent monopile driving technology into a commercial offering: Osonic

An interesting move from Ørsted, which takes a major step towards the mainstream adoption of low-noise solutions for offshore wind following an agreement signed with developer Luxcara.

For those unfamiliar, underwater noise during monopile installation is one of the most environmentally impactful moments for marine wildlife. Conventional piling generates very high peaks that primarily affect marine mammals.

In markets such as Germany, the Netherlands, or the United Kingdom, this translates into operational restrictions, limited time windows for installation, and mandatory mitigation measures...

One of the best-known solutions is bubble curtains, “walls” of bubbles that reduce sound propagation, though they do not eliminate piling itself. The most disruptive alternative is to avoid piling altogether, and that’s where Osonic comes in.

Tested at Gode Wind 3, the technology developed by Ørsted reduces noise by more than 99%, down to levels barely above ambient noise in the North Sea.

What’s curious about this story is that Ørsted, being a developer, has decided to commercialise this technology. Probably as a way to monetise its know-how and validate the development in more locations.

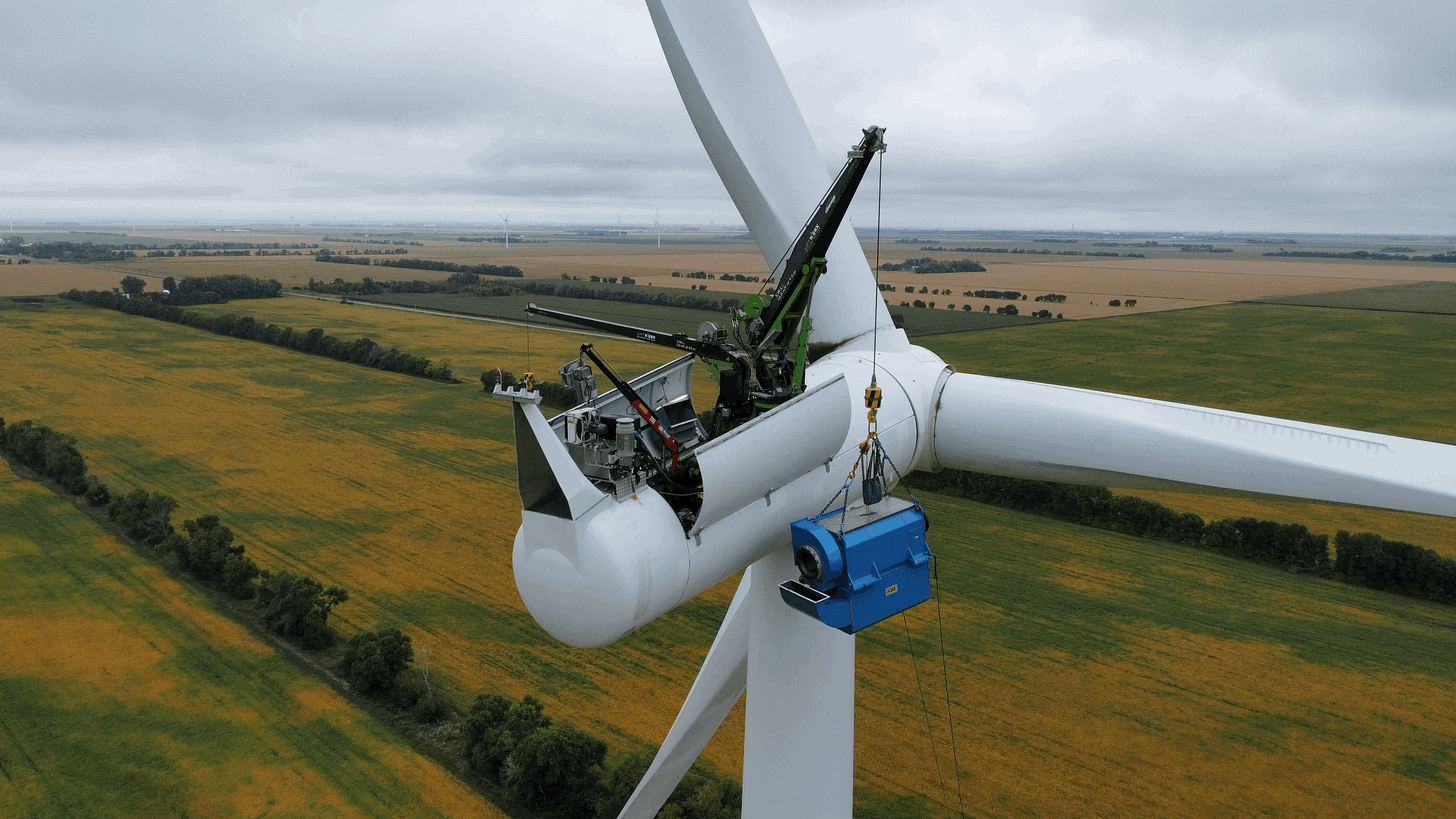

🏗️LiftWerx, the self-hoisting crane company, turns 10

As the wind turbine fleet ages, heavy corrective maintenance (or major correctives) becomes a key profitability factor, as it can have a significant impact on O&M costs. That’s the niche in which LiftWerx operates, a Canadian company specialising in major correctives without conventional cranes, now celebrating its 10th anniversary.

LiftWerx was born from a very specific need: replacing gearboxes, generators, or rotors without relying on high-tonnage cranes, which are generally expensive and scarce. And they can offer it as a full service, they don’t just sell the crane, they carry out the work with their own teams.

I truly find this business model very interesting, since the only alternative is considerably more expensive, and now that many wind farms are entering their second decade of operation, major correctives are becoming increasingly common.

Many of you have probably also thought of Liftra, which, if I’m not mistaken, is their only competitor. Truth is, I’m not sure what the differences are between the two companies and their products/services.

🌊Siemens Gamesa intends to commercialise the SG21.5-276

Siemens Gamesa appears to be gradually revealing its plans around the 21 MW, 276-metre rotor diameter offshore turbine currently being tested at Østerild.

Until now, the company had treated this prototype with considerable caution, as much as possible, since hiding a machine of this size is impossible. Even the CEO of Siemens Energy had publicly referred to it as a simple test turbine.

However, according to Recharge, an executive from Siemens Gamesa has now publicly acknowledged that the ultimate goal is to bring it to market, provided it demonstrates reliability levels equivalent to those of current platforms.

For the time being, the company doesn’t seem willing to rush the process. Before launching such a large machine commercially, Siemens Gamesa wants to thoroughly validate its performance in real-world operation, accumulating hours, data, and experience.

So, for now, we’ll need to be patient.

🚁Why Chinese offshore turbines don’t have helipads

An interesting point made by Gang Wang on LinkedIn, who was recently used in a private conversation as an example by a senior in the industry to explain the distance that currently exists in offshore between Western and Chinese OEMs. This is the case of helipads on offshore wind turbines in China.

According to Gang Wang, when Chinese offshore began to take off in the early 2010s, the priority was deployment speed and strict CAPEX control. Unlike in Europe, where offshore safety was integrated early in development, China at the time had no national standards requiring helipads for projects close to shore (≤30 km).

For 3–5 MW turbines, adding a helipad meant an additional $120,000 to $225,000 per machine, plus structural reinforcements. In a cost-driven market, this extra cost was deemed dispensable, with operation, maintenance and evacuation relying exclusively on marine transport.

The regulatory framework has evolved, and the rules now require helipads in offshore projects located far from shore (≥50 km) or in particularly harsh marine conditions. Between 30 and 50 km, it’s enough to reserve adequate space, and for projects within 30 km there are no specific requirements beyond boat-based rescue.

It might seem like a simple issue to solve, but matters related to regulations, safety and similar aspects often require many hours of work.

🧩Modular blades: a rarity still alive in some wind farms

We recently talked in Windletter about modular blades and why, despite their theoretical appeal, they’ve never really taken off commercially. Complexity has outweighed logistical advantages, which have been solved instead through transport innovation (mainly blade lifters).

Still, there are some operating wind farms that do include them. More recently, GE Vernova has used modular solutions in selected turbines from its Cypress platform. But if we go back more than a decade, the most iconic case is Gamesa’s G10X, which had a version fitted with modular blades.

What’s interesting is that some of those G10X turbines are still operating today, and so are their blades. Thanks to some images shared by David Hernández on LinkedIn, we’ve been able to see a recent maintenance job in Germany, at the Debstedt project, on one of these machines.

It’s a rare intervention that exposes the modular junction, something that’s now a real rarity in the wind industry. Seeing this kind of connection in real-world operation feels almost like industrial archaeology.

One day, we’ll dedicate a full article to the G10X, a turbine ahead of its time.

⚡Conducting a short-circuit test on an entire wind farm

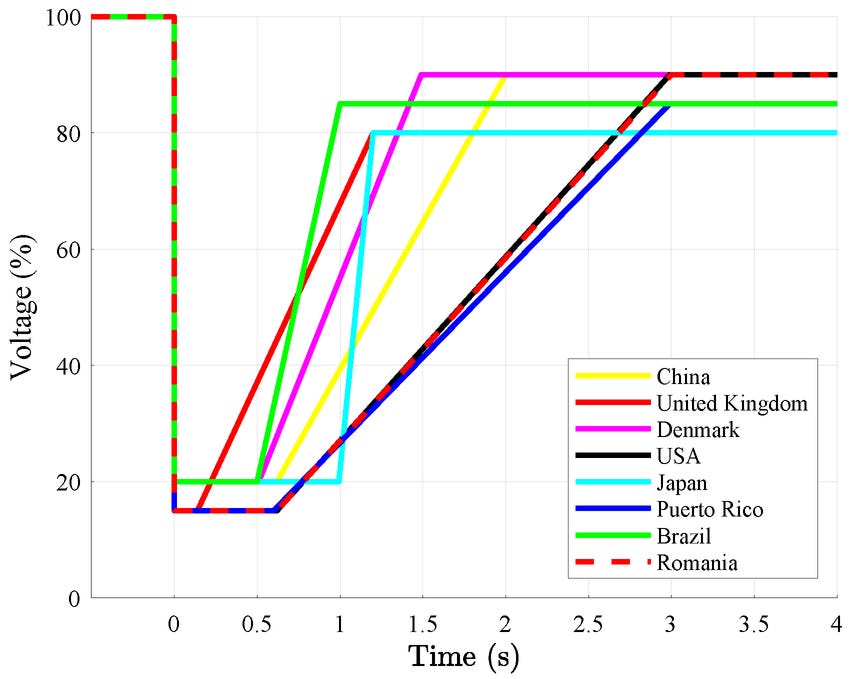

LVRT (Low Voltage Ride Through) refers to the ability of a wind turbine to remain connected to the grid during a severe voltage dip, typically caused by a short circuit.

Instead of disconnecting, the turbine must withstand the voltage dip, inject reactive power, and return to normal operation once the grid stabilizes. This is a critical requirement in systems with high renewable penetration, where massive disconnections could worsen a disturbance and, in the worst-case scenario, lead to blackouts.

As far as I know, in Europe, these tests are usually carried out at the individual turbine level. A specific model is certified under controlled conditions, and that certificate is then valid for all units of the same type.

In this case, Goldwind took a different approach. The test was conducted on an entire wind farm, inducing a short circuit and observing the combined response of all turbines.

Specifically, the test was carried out on a wind farm with 32 units of the GWH182, based on Medium Speed Permanent Magnet Generator technology. It’s a testament to the scale and boldness of deployment in China, where testing full-scale wind farms isn’t off the table.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.