Windletter #121 - Chinese manufacturer Ming Yang announces €1.7 billion for a factory in the United Kingdom

Also: the circular journey of dismantled wind turbine components, a floating vertical-axis wind turbine prototype, the world’s largest bearing test bench, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most read pieces from the latest edition have been: the map with more than 30,000 wind turbines in Germany, the images of the launch of Eolmed’s floaters, and the article on renewables in rural environments.

Now, let’s get to this week’s news.

🏭 Ming Yang announces €1.7 billion investment for a wind turbine factory in the United Kingdom

The Chinese manufacturer Mingyang Smart Energy, the world’s fourth-largest wind turbine producer with strong expertise in offshore wind, has announced a historic investment of up to £1.5 billion (around €1.73 billion) to build an offshore wind turbine manufacturing plant in Scotland.

This news has once again reignited the debate over China’s presence in critical industries in Europe.

In fact, the topic goes back some time: in April last year, the Scottish Offshore Wind Energy Council (SOWEC) had already listed the Chinese giant’s factory as a strategic project for developing Scotland’s offshore wind supply chain.

Several voices in the sector regard Ming Yang as one of the most “westernised” Chinese manufacturers, and the company has indeed spent years preparing its entry into the European wind market and building credibility.

According to Ming Yang’s own press release, the project consists of three phases and could create 1,500 direct jobs in the first one:

Phase 1: Invest up to £750 million to create an advanced manufacturing facility for both nacelles and blades, with production expected to start by late 2028.

Phase 2: Expand the plant and its infrastructure to support the large-scale rollout of floating offshore wind technology in the UK.

Phase 3: Develop an offshore wind industrial ecosystem around the hub, including the production of control systems, electronic components and other key elements.

The preferred location for the plant is Ardersier Port, near Inverness (Escocia).

For years, there have been reports about Ming Yang’s potential arrival in Europe, but this time the Chinese company seems closer than ever to taking the final step. The announcement comes after more than two years of negotiations between the OEM and the UK and Scottish governments, amid a strong push to strengthen the local wind supply chain.

However, it is important to note that the investment still requires final approval from the UK government, which has pledged to assess the operation under national security criteria.

Indeed, the United States warned the UK a few months ago about the potential risks of allowing such an investment in the country, as reported by the Financial Times. The matter has also sparked significant political controversy domestically.

Recently, Ming Yang announced a strategic partnership with Octopus Energy, which plans a 6 GW project pipeline in the UK. The company also received bad news with the cancellation of its agreement with Luxacara as preferred supplier for the Waterkant offshore wind farm in Germany.

Personally, I think this topic raises many questions: should we focus on the manufacturer’s origin (OEM), the place where the turbine is assembled, or the source of each of its components?

Is a turbine from a Chinese OEM assembled in Europe with some local components more “European” than a turbine from a European OEM built entirely from Chinese parts?

Beyond the Ming Yang case, the issue goes far beyond economics: Europe faces the challenge of maintaining its leadership in a market where Chinese manufacturers already dominate more than 60 % of global installed capacity.

And although everything suggests that, in the short term, Western OEMs will continue to dominate their local markets, China’s push to gain a foothold in Europe has never been stronger.

♻️ RenerCycle and the circular journey of dismantled wind turbine components

One of the big questions that arise when dismantling a wind farm is how much material can actually be recovered or recycled.

Thanks to our sponsor RenerCycle and its participation in the dismantling of the Muel wind farm, we have gained first-hand insight into the final destination of each component.

The figures from the Muel case are truly remarkable: according to Bureau Veritas certification, 99.85% of the total material weight has been recycled or recovered for new uses, a figure that nearly reaches the ZeroWaste goal, the very raison d’être of RenerCycle.

Achieving such a high percentage is no coincidence. The key lies in RenerCycle’s proprietary process, along with the characteristics of the retired model, the Nordtank 600/43, which features a metallic nacelle that facilitates recovery compared to fibreglass ones.

Thanks to RenerCycle, we’ve been able to access first-hand information on how the different parts of the turbine were managed: blades, towers, permanent magnets, small and large components, copper, oils…

Very soon we will publish a full report with all the details of the project, the dismantling process, and the traceability of each material.

If you don’t want to miss it, subscribe to Windletter.

🖥️ A data center with 200 MW of wind self-consumption, 100 MW of solar and 45 MW of batteries

On 15 July, China inaugurated its first data centre powered directly by renewable energy. The facility combines wind, solar and battery storage, coordinated through an intelligent management system, in addition to a connection to the electrical grid.

The project, developed in Ulanqab (Inner Mongolia) by Centrin Data, integrates 200 MW of wind, 100 MW of photovoltaic and 45 MW of storage, generating 848 GWh of renewable energy annually. This represents 38.7% of the data centre’s consumption, while also reducing power demand thanks to the battery and “peak shaving.”

The wind farm is composed of 26 Goldwind GWH221-7.7 MW turbines with a hub height of 125 metres.

The Ulanqab region is particularly attractive for data centres, as it offers good wind resources, ample available land, and an average annual temperature of around 5°C, which significantly reduces cooling needs.

With the rise of artificial intelligence, data centres are expected to become a major activity in the coming decade. Projects like this, linking renewable generation and storage directly to data centres, can substantially lower their energy costs as well as the emissions associated with their operation.

In that sense, Spain could have a major opportunity to attract this kind of investment. Will we see a similar facility here in the coming years?

📊 The future of wind power: the growing gap between Chinese scale and Western strongholds

An interesting analysis by Wood Mackenzie in its Global Wind Turbine OEMs Market Share Forecast report shows that the global wind industry is entering a new phase marked by an ever-widening gap between the dominance of Chinese manufacturers and the retreat of Western OEMs toward their traditional markets.

According to Woodmac, Chinese manufacturers enjoy up to a 32% price advantage over their Western competitors, driven by the huge scale of the domestic market, vertical integration, and aggressive expansion into certain international markets.

It is estimated that between 2025 and 2034 alone, they will install more than 200 GW outside China, reaching a 27% share in international markets. Meanwhile, European and North American manufacturers continue to hold their position in mature markets, where they control more than 95% of installations.

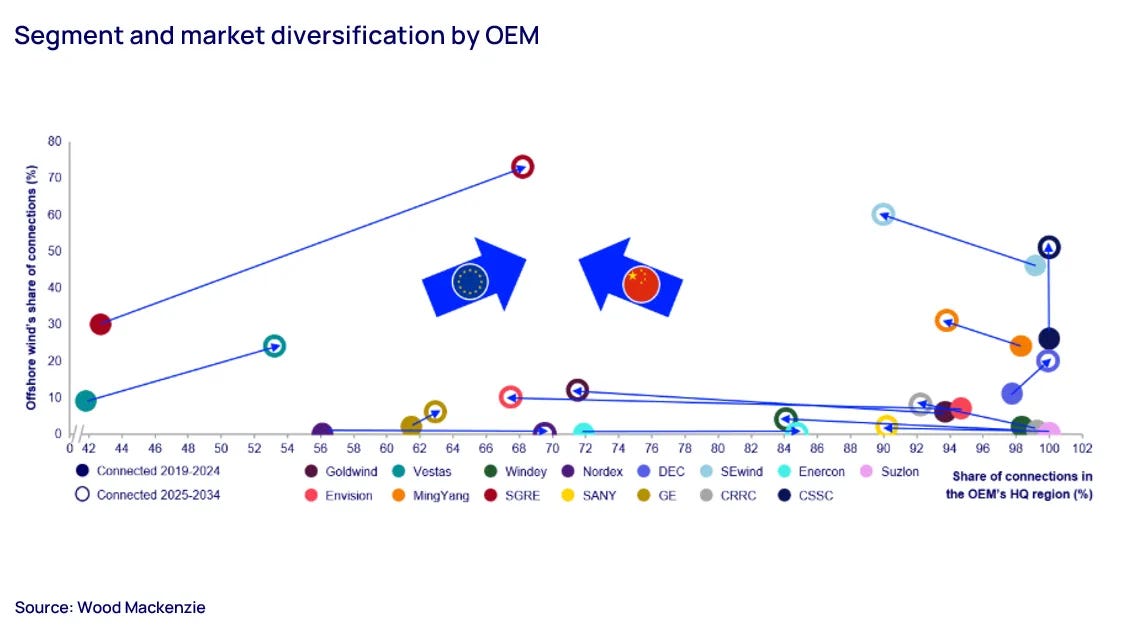

The following chart on the offshore sector, although somewhat complex to interpret, is particularly interesting. On the horizontal axis, it shows the degree of concentration in the local market: the further to the right, the more dependent manufacturers are on their home market. On the vertical axis, it represents the share of offshore versus onshore wind.

Woodmac forecasts that Vestas and Siemens Gamesa will continue to dominate the offshore market outside China (with a 92% share) but expects Mingyang to capture a share of the market thanks to floating wind.

An excerpt of the report can be downloaded from Wood Mackenzie’s website.

💶 €15 million for a 2 MW floating vertical-axis wind turbine prototype

The consortium behind the Verti-Go project has secured €15 million from the Horizon Europe programme to test SeaTwirl’s technology through a 2 MW prototype. The project covers design, manufacturing, installation, and operation.

The project was selected under the European call “Demonstrations of innovative floating wind concepts” last May and, after completing the preparation and agreement-signing process, officially started on 1 October 2025.

The design phase will continue until the end of 2026, while the construction and operation phase is planned to last until the end of 2029. The call itself requires that the testing period lasts between 12 and 24 months.

SeaTwirl already has previous experience: in 2015 it installed its 30 kW S1 prototype at the Lysekil test site in Sweden, and more than two years ago obtained a concession at Norway’s METCentre, where Stiesdal’s TetraSpar prototype is located, to deploy its 1 MW S2x platform (although this has not yet taken place).

At this link you can find a video of a recent presentation of the technology held in Stockholm. It’s in Swedish, but the slides are in English and YouTube’s automatic subtitles can be used.

⚙️ The world’s largest wind turbine bearing test bench inaugurated in Denmark

In Lindø (Denmark), the world’s most powerful wind turbine bearing test facility has just been inaugurated, the result of collaboration between Schaeffler, the Lindø Offshore Renewables Center (LORC), and R&D Test Systems.

The test bench weighs 560 tonnes, measures 16 metres in length and over 8 metres in height, and will enable the simulation of the extreme loads borne by the bearings of wind turbines with rotor diameters of up to 300 metres and capacities of around 25 MW.

Main bearings are a critical component, especially in large-scale turbines. These bearings are extremely expensive to manufacture and replace, and they are subject to significant wear due to the aerodynamic loads caused by the wind.

As turbines increase in size, the design and reliability of these bearings become an ever greater challenge.

In the event of critical failures, these bearings can only be replaced by disassembling the hub and generator, an operation that requires large offshore vessels and is therefore highly costly and involves long downtimes.

This is why proper design and testing are essential for the reliability of the entire industry.

⚠️ German wind turbine manufacturer Eno Energy declares bankruptcy

We’ve recently talked in Windletter about the German wind turbine manufacturer Eno Energy, a company little known to most, which throughout its history had installed barely 800 MW and around 380 wind turbines, most of them in Germany.

Well, a few days ago they announced that they are bankrupt.

Founded in 1999, Eno Energy began developing wind turbines in 2005 and installed its first unit in France in 2008.

According to the available information, Eno Energy employs around 300 people across six locations in Germany, including its production facilities in Rostock. Logic suggests that many of those 300 employees are likely involved in other business areas such as development or maintenance.

Among Eno Energy’s milestones was the recent installation of a prototype of its Eno 160-6.00 MW model, with the size and power to compete directly with Western onshore models.

In terms of technology, its turbines feature a drivetrain with an electrically excited synchronous generator (without rare earths), gearbox, and full converter. If my memory serves me right, no other manufacturer currently uses this configuration (except Enercon, which employs it in its smaller models).

💉 A tattoo inspired by the motherf*ckin’ wind farms

LinkedIn’s timeline sometimes brings truly surprising things.

This time, the protagonist is David Stewart, Senior Social Media and Communications Officer at RenewableUK, the UK’s renewable energy association. David decided to get a tattoo on his calf, and quite a large one, of Vattenfall’s “Motherf*ckin’ Wind Farms” campaign.

For those who don’t know what I’m talking about, it’s the brilliant ad starring Samuel L. Jackson, to which we dedicated a Windstory a few weeks ago.

The post went viral on LinkedIn, with more than 1,600 reactions and even Vattenfall itself commenting on it. Even Wavy Wonders, the company that makes the seaweed snacks from Vattenfall’s offshore wind farm, has promised to send him a package.

And rightly so 😁

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.