Windletter #128 – Germany installs 5 GW and awards 14 GW of onshore wind in 2025. What can we learn?º

Also: Norway awards two areas for floating wind, Liftra reaches 60 cranes operating worldwide, Envision also wants to enter the European offshore market, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most-read articles from the last edition were: the PhD thesis on the optimal size of offshore wind turbines, the study suggesting birds avoid wind turbines, and the spectacular logistics manoeuvre on the island of Martinique.

Now, let’s dive into this week’s news.

🇩🇪 Germany installs 5 GW and awards 14 GW of onshore wind in 2025. What can we learn?

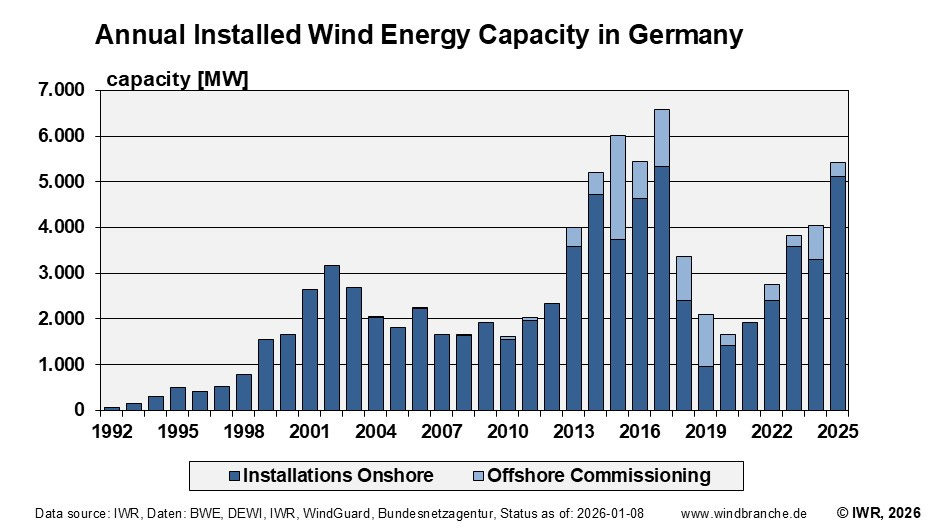

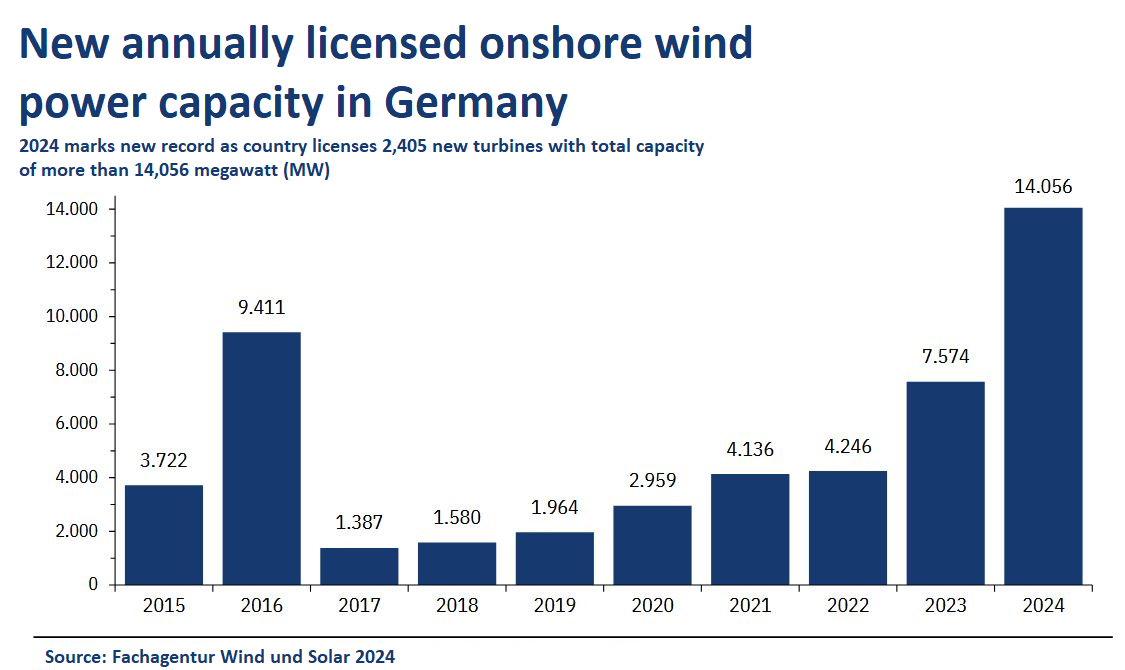

Germany achieved a historic milestone in 2025: more than 5 GW of new onshore wind capacity installed and 14.4 GW awarded through tenders, according to data from Bundesnetzagentur.

The 14.4 GW awarded shows an unprecedented acceleration in project permitting. Meanwhile, the 5 GW installed brings Germany back to its golden years of 2014–2017.

But the real question is: how has Germany managed to speed up permitting while other EU countries remain stuck? And what makes their auctions so attractive to developers?

Faster permitting: the key to Germany’s acceleration

One of the drivers behind Germany’s 2025 onshore wind boom is the dramatic reduction in permitting timelines. While many EU countries still take years to process applications (Spain’s legal limit is 5 years, often extended up to 8), Germany has cut the average to just 18 months.

For context, the EU REDIII directive sets an ideal benchmark of 24 months, a target no other EU country is currently meeting.

Germany’s progress relies on several measures:

Overriding public interest: Since 2022, renewable expansion is deemed of “overriding public interest,” giving it priority over other land uses.

Land targets and proactive zoning: German states (Länder) must designate at least 2% of their territory for onshore wind by 2032. This pre-zoned land, often pre-cleared through strategic environmental assessments, allows for simplified permitting.

For example, projects within designated areas are exempt from conducting a detailed Environmental Impact Assessment, if a strategic assessment has already been carried out and the site is not located in a Natura2000 zone. In projects following this fast-track route, a simplified environmental check and standardised compensatory measures for protected species are sufficient, avoiding duplication and cutting months from the process.

How Germany’s onshore wind auctions work

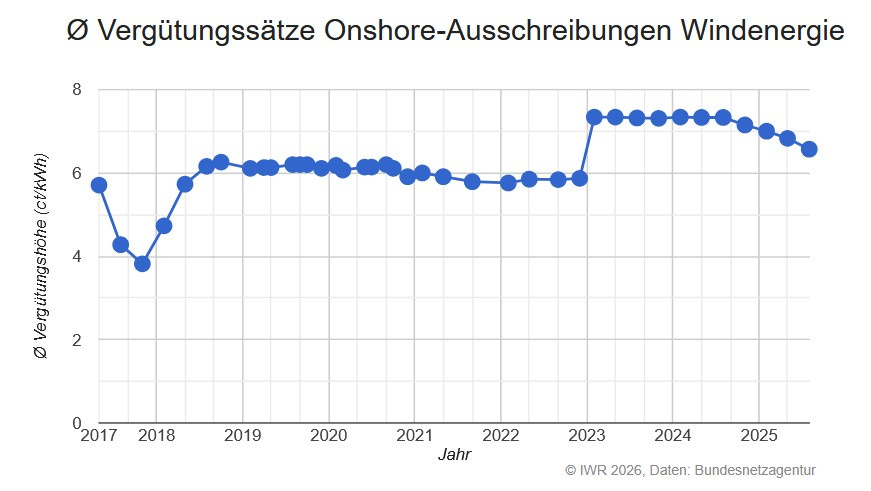

Another pillar of the 2025 success story is the design of the auctions. In 2017, Germany transitioned from feed-in tariffs to a competitive auction system to assign remuneration to new wind farms.

To participate in the auctions, it is mandatory to have a valid environmental permit under federal law (BImSchG). Each bid must also include a 30 k€/MW guarantee.

Four rounds are held each year (typically on 1 February, 1 May, 1 August, and 1 November). In 2025, each round offered around 3.45 GW of wind capacity.

Bundesnetzagentur publishes the volume to be auctioned and the maximum allowed price weeks in advance. In 2025, the cap was 73.5 €/MWh. All winners receive exactly the amount they bid. In 2025, a year with intense competition (for example, the November auction saw 8,155 MW of bids for 3,456 MW awarded, which is ideal), prices ranged between 58 and 66 €/MWh.

Once awarded, the developer has around 30 months to bring the wind farm online.

Regarding the tariff, wind farms sell their electricity on the wholesale market but receive a market premium to top up to the awarded price. Note: this is not a two-sided CfD, if the market price exceeds the awarded value, the operator keeps the higher revenue. There is no clawback. The support duration is 20 years.

All these ingredients have allowed the market to gain momentum: 11 GW awarded in 2024 and 14.4 GW in 2025, which will materialise over the coming years.

The German government has a clear roadmap to 2030: 115 GW of onshore wind installed. A target that implies installing ~9.4 GW annually from 2025 onward.

🌊 Norway awards two areas for floating offshore wind

Good news for floating offshore wind. Norway has taken a key step by awarding two projects in the Utsira Nord area to two consortia led by Equinor and EDF Renewables, marking the true beginning of what will be the country’s first large-scale floating development.

The awarded consortia are:

Equinor–Vårgrønn (Vårgrønn is the joint venture between Eni Plenitude and HitecVision).

EDF–Deep Wind Offshore, through the Harald Hårfagre consortium.

It is important to clarify that this is not yet an award with financial support. This phase acts only as a prequalification: the consortia will be able to carry out technical and environmental studies and apply for permits.

Later, likely in 2028–2029, Norway will hold an auction, in which the project requiring the least public support will win (for which the country already has authorisation). There is no classic CfD or defined tariff planned; the projects will receive CAPEX support. Forecasts suggest operations could begin from 2034 onwards.

Norway, and Equinor in particular, is one of the world’s great pioneers in floating wind, with projects such as Hywind Scotland and Hywind Tampen. Utsira Nord represents the leap from demonstration projects to commercial scale.

🧠 The use of digital twins to optimize offshore operations

An interesting video posted on LinkedIn by Markus Wiemann, Global Head of Construction Offshore Wind at Siemens Gamesa.

Markus talks about how 3D digital twin simulations help improve and optimise operations at ports and also the activities of offshore wind turbine installation vessels.

Ports are a key point during the construction of wind farms, as they are where all the components are stored and sometimes pre-assembled before being loaded onto the vessels.

Proper storage, transport and handling of all components is essential both to optimise timing and to ensure safety.

And since every port is different, and we’re talking about components weighing tens of tonnes, the only way to learn, optimise and ensure everything will go smoothly is by using a digital twin. In the video, in fact, both the digital layout and the real layout are shown.

It is important to remember that SGRE had a very active year in offshore during 2025, and 2026 is expected to be a record year.

🛠️ Liftra reaches 60 cranes operating worldwide

Liftra, the Danish manufacturer specialised in solutions for the installation, maintenance and transportation of wind turbine components, now has more than 60 self-hoisting cranes operating in over 20 countries since its market launch in 2013. A figure that confirms the level of adoption of this technology in the sector.

The Liftra cranes allow the replacement of components such as gearboxes, generators or main shafts without the need to mobilise a conventional crane of several hundred tonnes, resulting in significant savings for wind farm operators.

The operation is carried out from the nacelle through an interface system that anchors the crane to the wind turbine, significantly reducing CAPEX and downtime.

One of the keys to success has been Liftra’s ability to adapt its products to various platforms and wind turbine models. Compatibility information can be found in this pdf.

Liftra’s business model offers different schemes depending on customer preferences:

Ownership: sale of the crane, with the option of operation by the client or Liftra.

Rental: leasing of the equipment, available with or without Liftra’s specialised personnel.

Service: long-term framework contracts for the full management of major corrective operations.

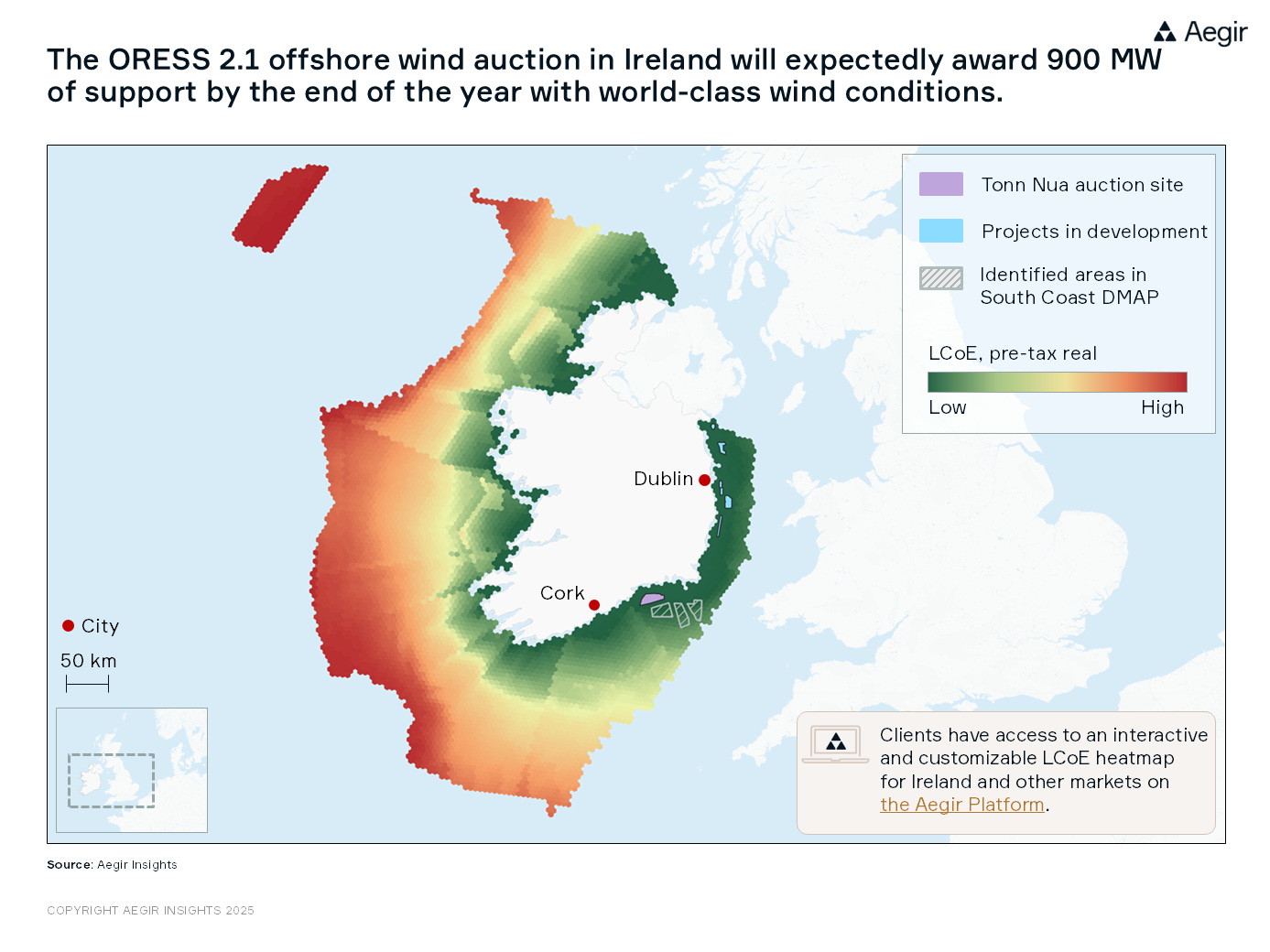

🇮🇪 ireland awards its first large offshore wind farm… over 20 years later

Ireland has finally taken a step that had been pending for more than two decades. The country has awarded its first large offshore wind farm, ending a long journey through the desert since Arklow Bank.

Ireland is an onshore wind powerhouse, at least for a country with just 5.4 million inhabitants. It has more than 5 GW installed and an electricity system that relies heavily on wind. However, offshore development has been minimal, despite having good wind resources.

The only operational wind farm is Arklow Bank, with just 25.2 MW, which entered operation in 2003 and consists of 7 GE 3.6s turbines with 3.6 MW capacity and 104 m rotor diameter.

That now changes with the award of the 900 MW Tonn Nua project in the country’s second offshore auction (ORESS). The project has been awarded to the joint venture between Ørsted and Irish utility ESB.

The project has secured a 20-year CfD with a strike price of €98.72/MWh, partially indexed. In a context where several auctions have failed in Germany, the Netherlands or Denmark, Ireland’s result is great news for the European offshore sector.

Located off the coast of Waterford, its commissioning is expected in the mid-2030s, with a deadline of 1 January 2037.

🇮🇳 Siemens Gamesa completes exit from India: Vayona Energy is born

A few months ago, Siemens Gamesa announced the sale of 90% of its onshore wind business in India and Sri Lanka to a consortium led by TPG, together with local investor MAVCO and other partners. Now, the deal is complete and comes with a new name: Vayona Energy.

The agreement was officially closed last December, concluding a process that began in March. The new company takes over around 1,000 employees, two manufacturing plants, and an installed capacity base of around 10 GW, along with 7 GW under long-term O&M contracts. Vayona Energy starts off with an order book exceeding 1 GW.

Nearly 100%, if not the full 100%, of that fleet uses “Gamesa” technology, since India was for several years one of the main markets for the former company.

Why this move? India is a market with enormous potential, Siemens Energy itself estimates 57 GW of additional capacity by 2032, but also highly competitive (especially with the entry of Chinese OEMs), price-sensitive, and with very specific local dynamics.

🌊 Envision eyes european offshore: hires Global Director of Sales and Business Development

The arrival of Chinese OEMs to the European offshore market will still take time. But that doesn’t mean they’re not trying. On the contrary: increasingly concrete moves point to a more determined strategy.

Leading the charge is still Ming Yang, likely the most active Chinese manufacturer in international marketing and communications, and, according to industry sources, the most “Westernised” in how it operates with clients. Its announcement of a factory in Scotland made waves, and recently it took another key step by appointing a dedicated CEO for Europe, a clear signal of mid-term ambition.

Just behind comes Envision Energy. Its offshore presence is even more discreet, but it’s starting to lay the groundwork. The clearest sign? Hiring senior European talent, such as Javier Torrijos Cuesta as Global Director of Sales and Business Development for offshore, coming from Statkraft.

This move is especially relevant because it’s not about engineering or manufacturing, it’s about sales, business development and building relationships with European clients. In other words, understanding the processes, risks, contracts and dynamics of the European offshore market.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.