Windstory #23 - Power grids are the new investment trend: these are the reasons why

Major electric utilities have announced a strategic shift: reducing their investments in renewables to prioritize power grids. What are the reasons behind this move?

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

Windstory is the articles section of Windletter, where we publish single-topic analyses and share interesting stories from the wind energy sector.

From time to time, without a set schedule, a new edition of Windstory will arrive in your inbox. You can read other features here.

Let’s talk about the trending topic in the power sector: grids. We’re stepping a bit outside our usual focus, but it’s important to understand why there’s so much talk about power grids lately, and why some of the main players in the renewable energy industry are ramping up their investment in this sector.

⚡ Why is everyone suddenly investing in power grids?

In recent months, several of the largest Western utilities have announced a strategic shift: reducing their investments in new renewable generation and redirecting billions toward transmission and distribution networks.

Europe’s main utilities have been presenting plans that focus their growth on electricity grids, cutting back on investments in so-called variable renewables (solar and wind).

📊 Recent announcements from the big players

Two of the most significant examples can be found in the strategic plans unveiled by Enel and Iberdrola.

Enel. In November 2024, Italian utility Enel presented its 2025–2027 strategic plan, prioritizing “regulated assets with predictable returns.” The group will increase investment in grids by 40% compared to the previous plan, reaching around €26 billion in the 2025–27 period, mainly focused on distribution networks in Italy and Spain (via Endesa).

Conversely, it will slow down renewables deployment, adopting a “more selective” approach and partnering with others. Its renewable generation CapEx will be around €12 billion over the same period, less than half of the grid investment.

You can view the investor presentation here.

Iberdrola. This past September, in its strategic update, Iberdrola announced plans to invest €37 billion in grids by 2028 (65% of its total CapEx), with grids expected to grow from contributing 35% of profits to 55% by 2028.

€21 billion will go to Renewables and Customers: 38% to offshore wind, 24% to onshore wind, 10% to solar PV and 10% to storage.

You can view the investor presentation here.

🔌 What has changed? Why this sudden focus on grids?

The grid is becoming a bottleneck for electrification. And it’s happening on two fronts.

On the one hand, electricity demand is starting to rise. After more than a decade of flat or even declining demand, the 2035 horizon foresees an increase of up to 50% in some of the world’s leading economies.

This growth is driven mainly by the electrification of energy demand (electric vehicles, heat pumps, electrification of industrial consumption), as well as by other sectors such as data centres and artificial intelligence.

To give one example, Iberdrola forecasts annual demand growth of 3% in the Eurozone and UK over the 2023–2035 period, and 2% and 2.5% in the United States and Brazil, respectively.

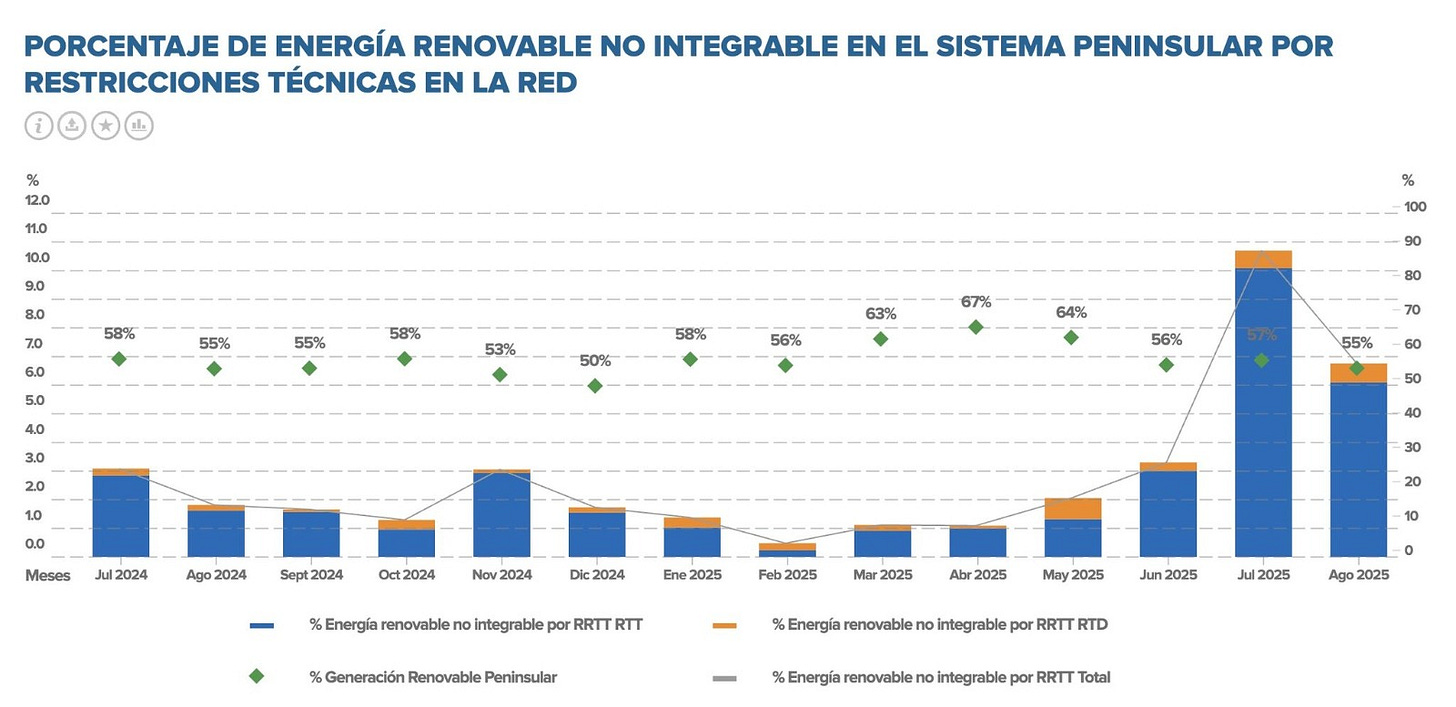

On the other hand, the lack of grid infrastructure is beginning to trigger “curtailments”. In high-renewables scenarios, several European countries are already struggling to transport electricity from generation hubs to consumption centres.

Capital costs. For years, financing costs were at rock bottom. However, the sharp rise in interest rates since 2022 has significantly increased the cost of project financing.

When a large portion of your margins go towards interest payments, it becomes harder to make renewable projects financially attractive.

Rising costs. In some technologies like offshore wind, investment costs have surged between +20% and +40% since 2021, driven by inflation in commodities, logistics, and the aforementioned higher financing costs. Ørsted reported a 50% increase in LCOE in its White Paper.

Falling electricity market prices and cannibalization. The growing penetration of renewables is pushing electricity prices down in many markets, often below the initial forecasts made by investors.

This is known as cannibalization. When there is a lot of sun or wind, prices drop, reducing the average revenues that renewables receive compared to the market’s average price, a phenomenon referred to as “capture rate”.

For example, in Spain, where solar already accounts for 21% of generation, there were 693 hours with zero or negative electricity prices between January and September 2025. This trend is being seen in other markets as solar penetration increases. Wind energy, for now, is withstanding the impact better, with a capture rate much closer to average market prices.

Complexity of renewable development. Another key factor is that building new renewable projects has become more difficult and slower than expected, mainly due to bureaucratic and social barriers.

In Europe, environmental and urban planning permits still take several years, despite timid efforts to simplify the process, and project development can take more than 5 years. Grid access is also a problem in many markets, where the TSO does not grant permits for new plants or has a never-ending “waiting list”.

Social acceptance also plays a role: local opposition (NIMBY) to wind farms, solar plants and battery storage has triggered lawsuits and moratoriums in many countries.

Of course, this varies greatly depending on the country, and even the region. In the case of wind energy, Germany is the benchmark we should be looking at. One day I’d like to dive deeper into the reasons behind Germany’s success and what can be learned from it in other markets.

Renewable profitability is tighter. For all these reasons, it’s increasingly difficult to build projects with an attractive risk/return profile.

That’s why the strategy of major utilities has moved away from “volume” (building new plants at all costs) to prioritizing “value” (being more selective about which renewable projects to build and which not to).

Wind energy, especially onshore, still generally holds that “value”, and in many markets its issues are not related to profitability but rather to permitting and social opposition.

💸 Investing in grids at this moment offers greater control and certainty

Grid businesses, by contrast, provide predictable income and guaranteed returns set by regulation, typically a return on approved assets, sometimes even indexed to inflation. All of this comes with significantly lower risk.

This investment profile has a direct impact on financials: more stable earnings and fewer surprises from volatile market prices. And that’s something investors like.

Institutions and governments are also encouraging investment in grids. Recent regulatory frameworks offer reasonable, even competitive, returns. In Spain, however, utilities and the CNMC have been “discussing” grid remuneration for some time.

🔮 Looking ahead

Despite the current investment shift towards power grids, the outlook for renewables still offers plenty of reasons for optimism.

Storage has arrived to play a key role, reducing both curtailments and price cannibalisation for solar assets.

The electrification of the economy (for which grids are essential) will lead to higher demand, stabilising wholesale market prices and making clean energy generation more profitable.

The PPA market remains very active, especially in wind, and continues to be a strong tool to secure predictable revenues for renewable producers and shield them from electricity market volatility. Some countries are instead opting for public CfD auctions, which guarantee stable income through fixed-price contracts.

There is still a long way to go in the decarbonisation journey, and if the world electrifies as expected, electricity demand will rise significantly in the coming years. That demand simply cannot be met with competitive electricity without more renewable installations.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.