Windletter #118 - Wind turbines and wildfires: the recurring myth

Also: Nordex’s impressive recovery, Envision’s two-bladed prototype, Romania awards 1.2 GW onshore, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most-read pieces from the latest edition were: the photos of the DEC 26MW-310 HH185 installation, Iberdrola’s black-painted blade, and Mingyang’s statement on the cancellation of negotiations with Luxcara.

Now, let’s get into this week’s news.

🔥 Wind turbines and wildfires: the recurring myth

Following the devastating wildfires that have swept across Spain in recent weeks, a recurring narrative has once again gained traction on social media, one that resurfaces every so often. So much so, in fact, that we already addressed it two years ago in Windletter.

Certain posts and claims online suggest that some forest fires may be linked to interests related to the installation of wind farms. Of course, these accusations are entirely baseless, aimed at stirring controversy, going viral, and serving certain political agendas.

However, both Spanish regulations and the sector’s internal logic clearly show that this idea lacks any foundation.

The Spanish Wind Energy Association (AEE) responded with a detailed report (only in Spanish) explaining why all these rumours make no sense. I took the time to digest the document, do some additional research, and summarize it in a simple X (Twitter) thread, which received quite a lot of attention.

Given the response, we later expanded the content into a more detailed article for El Periódico de la Energía (thanks Ramón for the opportunity).

One of the main arguments behind these false claims is that burnt land is later rezoned for wind farm construction.

But the reality is that, in Spain, wind farms do not require a rezoning of the land to be built. In most regional urban planning regulations, a special designation or an exceptional use permit for non-urban land is sufficient.

Unlike urban or industrial developments, wind farms can be built on rural or forest land, as long as they obtain a favourable Environmental Impact Declaration (DIA) issued by the competent authority. Once built, the land retains its original classification, whether forest, agricultural, or pastoral.

If a site was environmentally unviable before the fire, it remains unviable after. A wildfire doesn’t make a piece of land suitable for wind turbines, nor does it exempt a developer from the environmental review. It doesn’t even make the process any easier.

Environmental assessments are always based on the original state of the land—not on what remains after a fire.

In fact, it’s worth highlighting that wind farms can actively help in wildfire prevention and early detection:

Access roads: they can act as firebreaks and facilitate rapid deployment of firefighting crews.

On-site personnel: can raise immediate alerts in case of emergency.

Revenue to regional and local governments: can help fund forest management, training programmes, and fire safety initiatives.

Developers: have a direct interest in preventing fires to protect their investment and preserve the surrounding environment.

I believe the spread of these kinds of rumours is not unique to Spain, it’s something we’ve seen in other European countries as well when similar tragedies occur. I’ve even come across some examples in Greece.

What I find truly disheartening is that, in 2025, we still have to deal with this kind of misinformation.

Does the same thing happen elsewhere? I’d love to hear from those of you reading from abroad. Though if you’re reading this from northern Europe… I guess wildfires aren’t exactly a big concern for you 😅

CITE25 Congress – The meeting point for the renewable energy industry

Pamplona will host the 4th International Congress of the Industry for the Energy Transition (CITE25), organised by Enercluster, on 23 October.

The congress will focus on key technologies such as wind energy, solar, storage, and green hydrogen, and will address topics like the challenges facing Europe’s renewable industry in a global context, new national and European legislation, technology trends, and the relationship between renewables and society.

You can check out the list of speakers here and the full agenda here. All the latest updates about the event are also being shared via the CITE Congress LinkedIn page.

🎟️ You can get your ticket by clicking on the banner just below.

By the way, I’ll be there too, so for those of you attending, I’d be happy to say hello and have a chat!

📈 The impressive recovery of Nordex

As many of you know, Western OEMs have faced several financially challenging years. Years marked by losses, tight margins, war, inflation, reliability issues… in short, a turbulent time.

But signs of recovery are finally here. And Nordex is one of the most notable examples, having now recorded several consecutive quarters in the black. For the first time, this quarter it has even topped the charts for onshore order intake among Western OEMs, surpassing the traditional leader, Vestas.

Our friend Kiko Maza has published an in-depth analysis tracing the journey of the Spanish-German manufacturer over the past five years, along with the key reasons behind its recovery.

The chart Kiko shares in the post is especially revealing. At a glance, it shows the evolution of Nordex’s net income and how it correlates with major events over the last few years: the pandemic, rising material prices, the war in Ukraine, the suspension of SG4.X and SG5.X sales…

I don’t want to “steal” Kiko’s article, so here’s the introduction and you can read the full piece on the WeMake Consultores website.

When, at the end of 2022, all Western turbine manufacturers were suffering million-euros losses and publishing plans to emerge from the crisis, few would have bet on the smallest OEM and, in theory, the one in the most delicate position: Nordex. But against all odds, Nordex has proven to be the star pupil in the difficult subject of “getting back into the black”.

⚡ Mingyang connects its first turbine to the grid in Brazil

Last September, we reported on Mingyang’s entry into the Brazilian market through an agreement with Copel, one of the country’s largest developers.

Now, the Chinese company has just announced the grid connection of its first turbine in Brazil, precisely as part of this project. The wind farm is located in the state of Rio Grande do Norte, in the northeast of the country, a region well known for its excellent wind resources.

The model selected for this pilot installation is the MySE 6.25-172, a turbine that, as you can see in the photo above, features the interesting Super Compact Drivetrain technology, which we already covered in detail in Windletter #69.

🎤 Trump says China has “very few wind farms” – but in reality, it’s the world leader with over 500 GW installed

The other day, Donald Trump made the following statement:

“I asked Xi (Xi Jinping) how many wind farms they have. They don’t have many. Very few. Wind energy is extremely expensive and very unpleasant. If you want a house inside a wind farm, your house is worth less than half. And there’s noise.”

In a good faith effort, I tried to understand what he meant by “very few”. So I looked up the numbers.

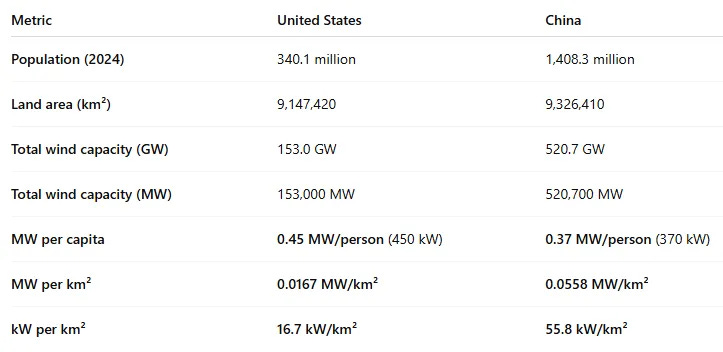

By the end of 2024, China had 520 GW of installed wind power, more than three times the United States, which closed the year with 153 GW.

Maybe he was referring to installed capacity per capita. In that case, with a population of 340 million in the US and 1.408 billion in China, the ratio is:

United States: 0.45 MW per person

China: 0.37 MW per person

So yes, the US comes out slightly ahead, but the difference is hardly dramatic.

If we calculate installed capacity per unit of land area, it’s a different story:

United States: 0.0167 MW/km²

China: 0.0558 MW/km²

China wins by a landslide.

I don’t know about you, but to me it doesn’t seem like China has “very few wind farms”. And just wait until you see the numbers five years from now…

⚙️ German manufacturer Eno Energy grants wind turbine manufacturing licence in Poland

An interesting move in the European wind sector: German manufacturer Eno Energy, through its subsidiary Enovation GmbH, has signed a licensing agreement with Polish company Grenevia SA. Thanks to this deal, Grenevia will be able to manufacture the eno126 model in Poland, in both its 4 MW and 4.8 MW versions.

Some of you may be wondering who Eno Energy is. We’ve mentioned them before, but for those unfamiliar: it’s a manufacturer founded in 1999 and based in Rostock, Germany.

Eno Energy has a track record of 800 MW installed. You can visit their website here.

It’s true that the Polish market is both interesting and growing, but even so, this move strikes me as quite surprising. Will they really be able to compete with the major Western OEMs?

On the other hand, why did they choose that particular turbine model for the license? The eno126 (in its 4 MW and 4.8 MW versions) seems broadly comparable to models like the V117-4.2 MW, V136-4.5 MW, SG132-5.0 MW, N133/4.8 MW, GE 4.2-117, or the E-138 EP3 4.26 MW. All of them are still commercially available, but they’re certainly not “best sellers” in today’s market.

We’ll try to keep an eye on further developments to see if any contracts materialise.

🌀 Envision claims to have successfully tested a two-bladed wind turbine prototype

Envision recently raised eyebrows with an intriguing LinkedIn post, in which it claims to have successfully tested a two-bladed wind turbine for over 500 days.

According to Envision, the prototype achieved 99.3% availability during this period, with performance comparable to that of traditional three-bladed turbines.

The turbine is based on what they call the Model X platform (yes, like the Tesla car). Envision states that this test “proves that two-bladed turbines are not only viable, but also commercially ready.” They highlight the following advantages:

Lighter modular architecture

Lower transportation and installation costs

Greater deployment flexibility

Backed by 10+ years of design, testing, and innovation

I’ve always found two-bladed wind turbines fascinating. In fact, there was a time when they had a bit of momentum. Currently, there are several prototypes and designs around the world, but no large commercial two-bladed turbines available on the market.

One day I’d love to write a Windstory about two-bladed turbines, their history, and why they never really took off. If you don’t want to miss it, make sure to subscribe.

🇷🇴 Romania awards 1.2 GW onshore in its latest auction as Vestas dominates the market

The onshore market in Romania has been very active lately, and it looks set to stay that way in the coming years.

Romania’s Ministry of Energy recently awarded CfDs to 49 renewable energy projects with a combined capacity of 2,751 MW:

23 wind projects totalling 1,263 MW

26 solar projects totalling 1,488 MW

The average winning prices were €73.89/MWh for wind (maximum price: €80/MWh) and €40.35/MWh for solar (maximum price: €73/MWh). These prices clearly reflect the significant differences in LCOE that have emerged between the two technologies over time.

Although, as we’ve discussed here before, not everything is about LCOE.

In this strong moment for the Romanian market, Vestas is clearly one of the big winners.

The Danish manufacturer has received numerous orders in the country, over 500 MW so far this year. Vestas currently has 1.5 GW installed in Romania and operates a network of five service centres, as well as a training centre. For context, the country currently has around 3.2 GW of wind power in operation.

What’s particularly interesting is that Romania continues to show a strong presence of Western OEMs, at a time when many Eastern European countries are seeing a growing footprint from Chinese manufacturers. This is the case in Serbia, Bulgaria, Greece, and even Romania, where the European Bank for Reconstruction and Development has financed a wind farm using Goldwind turbines.

🔩 The spectacular manufacturing process of an 11-metre-diameter flange

Iraeta Forgings, part of the GRI Renewable Industries group, regularly shares videos on its LinkedIn page offering a behind-the-scenes look at the manufacturing of flanges for the wind energy sector.

This is heavy industry at its finest, high-precision work involving high-strength steel, large-scale forging, presses exerting thousands of tonnes of force, and controlled heat treatments, among other complex processes.

All of it with one goal: to produce components capable of withstanding the enormous loads and extreme conditions faced by modern wind turbines.

This particular video comes from one of their factories in China.

These flanges are used to connect the different tower sections, as well as the tower-to-foundation and tower-to-nacelle junctions. Blades also use flanges to connect to the hub, although in that case they are smaller in diameter.

In offshore wind, flanges can reach up to 11 metres in diameter (like the one in the video), and must be manufactured in a single piece with extremely tight tolerances.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.