Windletter #124 – AR7 offshore wind auction in UK: everything you need to know

Also: modular blade solutions, Enercon wants to be more than a manufacturer, Goldwind’s results, and more.

Hello everyone and welcome to a new issue of Windletter. I'm Sergio Fernández Munguía (@Sergio_FerMun) and here we discuss the latest news in the wind power sector from a different perspective. If you're not subscribed to the newsletter, you can do so here.

Windletter is sponsored by:

🔹 Tetrace. Reference provider of O&M services, engineering, supervision, and spare parts in the renewable energy market. More information here.

🔹 RenerCycle. Development and commercialization of specialized circular economy solutions and services for renewable energies. More information here.

🔹 Nabrawind. Design, development, manufacturing, and commercialization of advanced wind technologies. More information here.

Windletter está disponible en español aquí

The most read articles from the last edition were: the video of the 300-metre GICON tower prototype assembly, Nordex’s remarkable recovery, and Carlos Martin Rivals’ article on floating platform designs.

Now then, let’s get to this week’s news.

🌊 Everything you need to know about the UK offshore wind auction AR7

The Allocation Round 7 (AR7) is the seventh auction under the UK’s Contracts for Difference (CfD) system. Under this mechanism, offshore wind developers (and other technologies) compete for contracts that guarantee a fixed price per MWh (strike price) for a defined period (20 years in this case).

If the market price falls below this level, the government pays the difference. If it rises above, the developer returns the surplus.

In this round, AR7 is exclusively focused on offshore technologies: bottom-fixed offshore wind and floating offshore wind.

When it takes place. The bidding window is scheduled between November 11 and 17, 2025, with results to be announced in January 2026.

Why it matters. The United Kingdom is Europe’s most significant offshore wind market, with more than 15 GW installed and a target of 43–50 GW by 2030 (although that target appears ambitious). The capacity awarded in this auction will be key to understanding the volumes expected in the coming years and will directly influence the European supply chain (blade, tower, installation vessel, and port manufacturers).

How much capacity is expected to be awarded and at what price. The UK government has allocated a budget of £900 million for bottom-fixed offshore wind (Pot 3) and £180 million for floating offshore wind (Pot 4). According to WindEurope, around 5–6 GW of new offshore capacity could be awarded, a significant figure but still below what is required to meet the 2030 targets.

What are the price caps. For AR7, the “Administrative Strike Price” (ASP) limits for offshore wind, in 2024 prices, are:

Bottom-fixed: £113/MWh ≈ €132/MWh

Floating: £271/MWh ≈ €317/MWh

In the previous AR5 round, the maximum price was much lower, set at £44/MWh (2012 prices for fixed offshore, equivalent to £61/MWh in 2024 prices). This level was deemed insufficient to cover rising supply chain costs and inflation, leading to the failure to award any projects in that round.

For AR6, the cap was raised to £73/MWh (2012 prices, equivalent to £102/MWh in 2024), resulting in nearly 5 GW of capacity being awarded.

How the budget translates into awarded GW. The allocated budget does not represent the total investment required to build the wind farms but rather the estimated annual cost to the government of covering the difference between the awarded tariff and the market price.

For example, if the awarded prices are around £100/MWh (€117/MWh), below the £113/MWh cap, and assuming a 45% capacity factor, the £900 million budget could support between 5 and 6 GW of new offshore capacity.

What about floating wind. In AR7, floating wind has its own budget of £180 million and a price cap of €317/MWh. This price is significantly higher than in France, where the latest floating projects have cleared at around €90/MWh. However, in France, grid connection costs are covered by RTE (the transmission system operator), so the scopes are not directly comparable.

Those interested in the upcoming UK project pipeline and future AR7, AR8, and AR9 auctions can read this insightful article by Robert Speht. Woodmac’s point of view is also very interesting.

Ad. The master’s degree I’d love to take.

🌊 Master’s in Offshore Wind Energy – UPC School (Universitat Politècnica de Catalunya)

Offshore wind energy will be one of the key pillars of Europe’s energy transition in the coming decade. Get ready to lead this change with the Master’s in Offshore Wind Energy at the UPC School.

📘 Hands-on training with industry experts

The master’s program combines advanced technical training with an applied approach and real case studies from the sector, taught by specialized faculty from both UPC and the offshore wind industry. You’ll learn about:

✔ Offshore technologies (fixed and floating)

✔ Analysis of wind, waves, and currents

✔ Maritime, environmental, and energy regulations

✔ Turbine design, logistics, and wind farm optimization🎓 Start date 1st edition: February 3, 2026

📍 Format: On-campus at UPC (Barcelona)

💶 Early enrolment discount until December 15 — limited seats available!🗓 Online Information Session – November 18 (6:00 PM CET). Find out how this master’s can boost your career in the offshore wind sector.

🇪🇸 EWT Systems wins its first order in Spain

At present, there are hardly any new turbines available on the market in the 0.5–1 MW range. The major manufacturers phased out their “small” models long ago, as demand declined and they could no longer compete in LCOE with higher-power machines.

In this context, the Dutch manufacturer EWT Systems B.V. stands out. The company specialises in small and medium-sized direct-drive wind turbines (from 250 kW to 1 MW) with rotor diameters between 54 and 61 metres, designed for industrial self-consumption, repowering, and distributed-generation projects.

This is an especially interesting power and size range to replace some of the historical “best-seller” turbines such as the V52, G52, E-53, AE-59…

EWT Systems has recently announced its first turbine order in Spain, with installation scheduled for mid-2026.

According to the company, it currently has more than 600 turbines installed worldwide since commercialization began in 2004. The United Kingdom is its largest market, with over 400 units in operation.

Is there still room for turbines of this size in today’s market? Probably yes, but in niche applications: industrial self-consumption projects, islands, remote areas, or microgrids.

Even so, with the upcoming wave of repowering, these machines will have to compete against the growing number of refurbished second-hand turbines soon to flood the market, many of them offered at very low prices and with still-attractive performance.

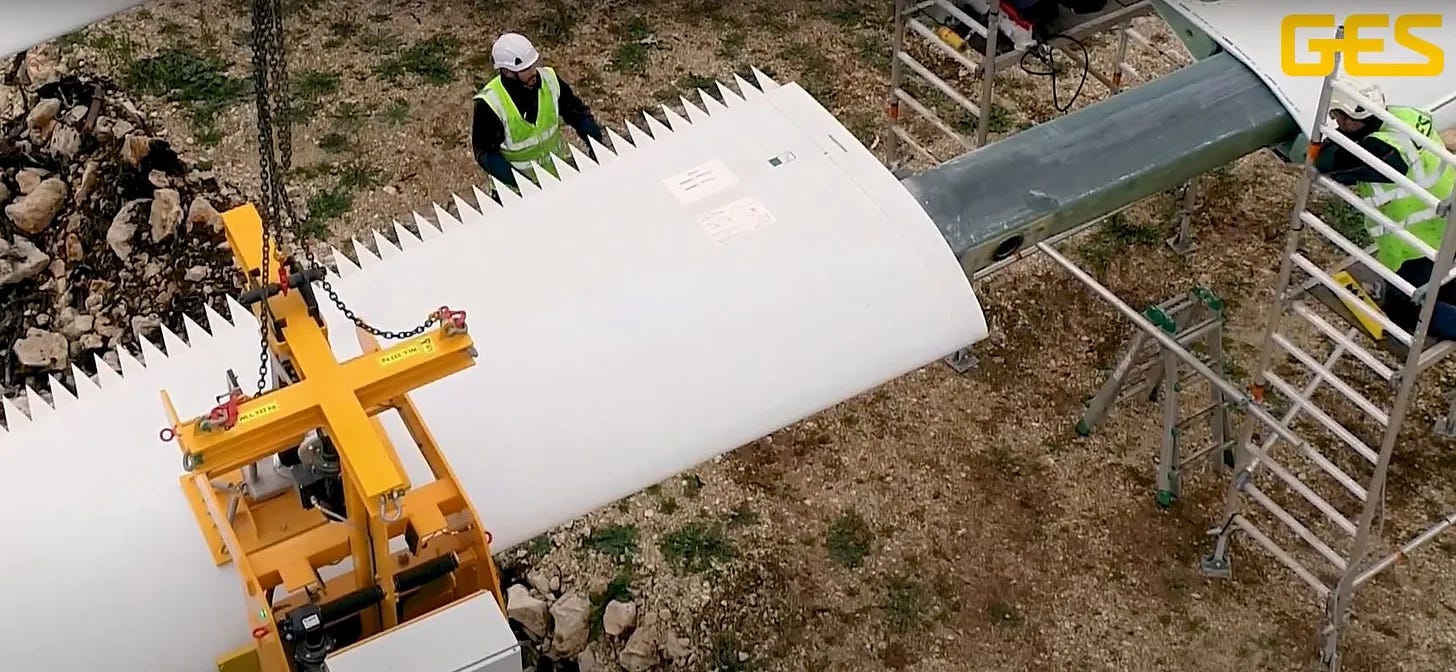

🧩 Modular blade solutions: an innovation that never quite took off

Windtechs has shared an interesting LinkedIn post about modular blades. It’s a topic we’ve discussed before in Windletter, and one that truly deserves a full article.

The fact is that, although several manufacturers have tried, modular blades have never really taken off. It’s unclear whether that’s due to the lack of reliable designs (which likely do exist) or simply because the market hasn’t demanded them (I’d lean towards the latter).

The promise of modular or segmented blades has always been to make transport easier, especially in very remote areas or complex terrains where road adaptations can become extremely costly. From that point of view, they might make sense as a niche solution.

However, in reality, logistics has managed to adapt to ever-larger blades, mainly through the widespread use of blade lifters.

Wintechs also mentions some of the possible risks and disadvantages of this type of blade:

Structural complexity: The connection between segments introduces stress concentration points and potential fatigue issues.

Higher manufacturing and maintenance costs: More components, more interfaces, more risk.

Aerodynamic penalties: Even with precise engineering, joints can affect blade performance.

Installation challenges: On-site assembly requires great precision outside a controlled environment and can depend on factors such as weather or technician skill.

The most recent example of a segmented blade in a commercial wind farm that comes to mind is a GE 5.5-158 at the Cuevas de Velasco wind farm in Spain.

💻 Aegir Insights expands its Aegir Quant™ software to onshore wind, solar, and energy storage

The Danish company Aegir Insights has announced an expansion of its Aegir Quant™ platform, a software tool specialized in renewable investment modelling, to now include onshore wind, solar photovoltaic, energy storage systems, and hybrid assets.

According to Aegir Insights, developers and investors can now assess projects and portfolios across multiple technologies within a standardized and bankable framework, enabling smarter decisions on investment and portfolio optimization.

In practice, the software helps developers and investors determine where to invest, how to optimize their portfolios, and which projects are the most profitable or bankable.

By extending Aegir Quant™ beyond offshore wind to cover onshore wind, solar, and storage, the company opens the door to a much broader market, addressing the full spectrum of renewable technologies, a move that, as a startup, greatly increases its growth potential.

The expansion has been developed in collaboration with Vattenfall, the Technical University of Denmark (DTU), and Energy Cluster Denmark, with support from the EUDP (Energy Technology Development and Demonstration Program).

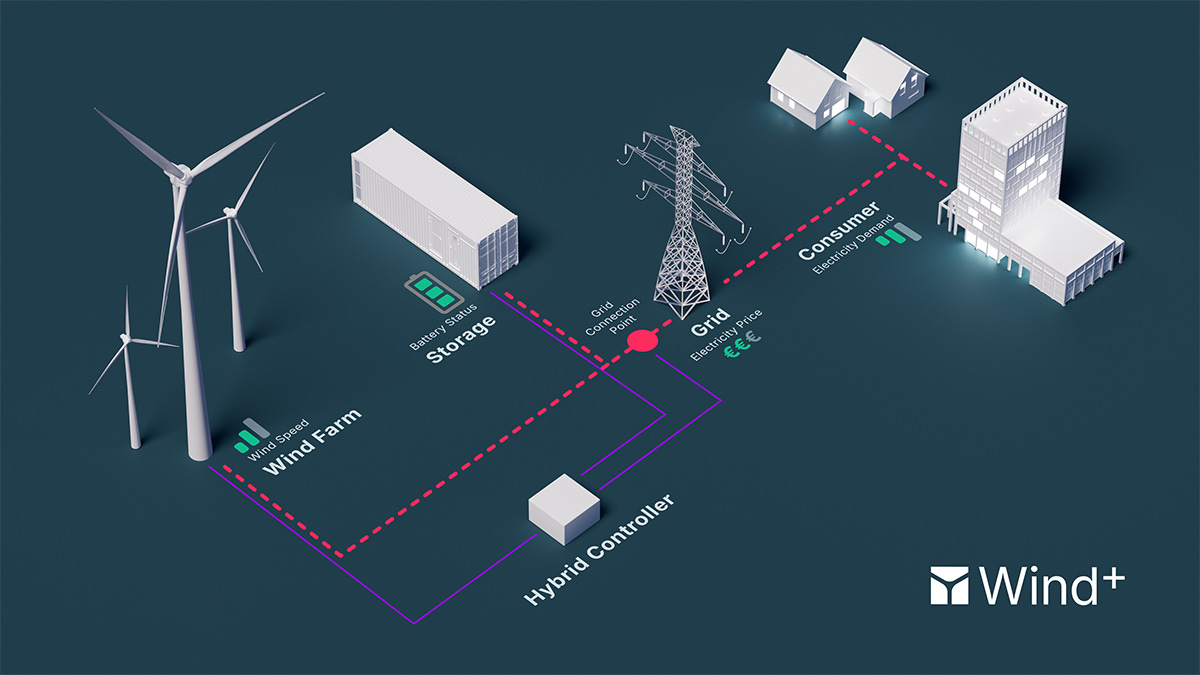

⚙️ Enercon wants to be more than a wind turbine manufacturer

This is not exactly breaking news, but it’s worth revisiting.

The German manufacturer Enercon has announced a strategic shift in its business model. From now on, it will offer services in three major areas: “end-to-end project engineering,” “connected operation,” and “smart optimisation.”

According to Enercon, this change is driven by increasingly demanding conditions for onshore operators and by the shift from guaranteed remuneration schemes to wholesale markets and corporate PPA contracts. This mainly refers to the German market, though it’s certainly a global trend. Their goal is to move from “Produce & Forget” to “Produce & Refine.”

End-to-End Project Engineering: Enercon now aims to support clients throughout the entire project lifecycle—from component selection, financing, site assessment, and permitting to delivery, installation, and commissioning. This also includes the design and construction of high-voltage substations and complex grid connections, or even hybrid projects integrating battery storage.

Connected Operations: In the operational phase, Enercon offers continuous monitoring, proactive maintenance, spare-part management, and cybersecurity, as well as support for energy trading in merchant markets and in connecting with potential offtakers.

Smart Optimisation: The company provides continuous performance improvement services, including power upgrades, optimised operating modes to reduce load or noise, and support up to the decommissioning stage. These upgrades can even be applied to discontinued models, helping maintain competitiveness throughout their full lifecycle.

This approach is particularly interesting at a time when most OEMs have been pursuing the opposite strategy, shifting as much risk as possible onto developers.

However, from my point of view, this strategy could work for Enercon, given that much of its business remains in Germany, one of the world’s leading wind markets. Scaling such services globally is far from easy, since many are market-specific and require local expert teams in each country.

You can read more in Enercon’s always insightful Windblatt magazine (page 13).

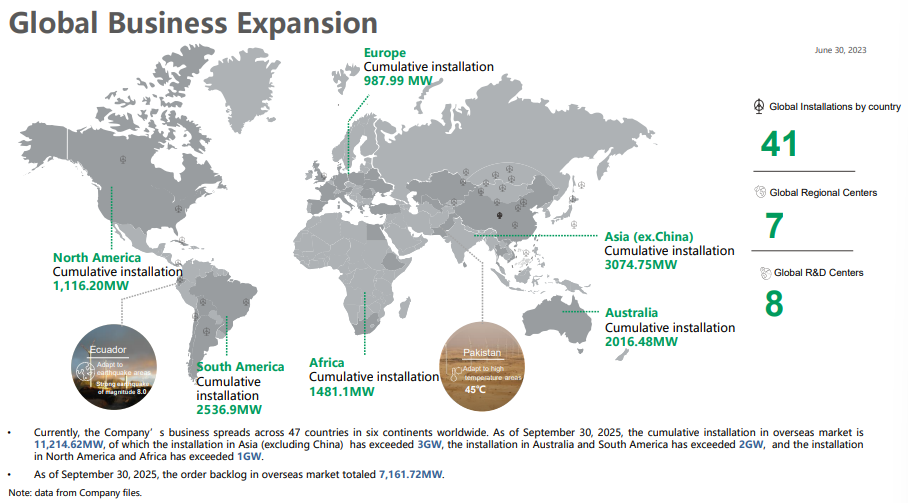

📈 Goldwind reports spectacular Q3 growth

Goldwind has released its Q3 2025 results, showing truly impressive figures that illustrate both the scale of its domestic market and its strong international expansion strategy.

Between January and September 2025, Goldwind sold 18,450 MW of turbine capacity, representing a +90% year-on-year increase.

Large turbines (≥6 MW) already account for 86% of total sales.

As of September 30, 2025, the company’s order backlog reached 52.5 GW, of which 49.9 GW correspond to external customers (that is, projects not developed by Goldwind itself).

Goldwind now operates in 47 countries and has installed over 11.2 GW outside China, including more than 3 GW in Asia, 2 GW in South America and Australia, over 1 GW in North America and Africa, and nearly 1 GW in Europe.

Its international order backlog outside China stands at 7.16 GW.

Solid financial performance:

Revenue: ¥48,147 million ≈ €6.1 billion

Gross profit margin: 14.4%

Net attributable profit: ¥2,584 million ≈ €327 million

One particularly striking figure is that, according to Goldwind, in September 2025 the average bid price offered by turbine manufacturers (WTG = Wind Turbine Generators) in Chinese public tenders was 1,610 RMB/kW (≈ €204,000/MW).

If we take €800,000/MW as a reference, that’s roughly 75% lower than Western OEMs. However, it’s important to note that project scopes in China differ significantly—it’s common for OEMs to supply only the nacelle, hub, and rotor, and often on an ex-works basis, excluding transport and installation.

Therefore, this figure is not directly comparable and must be interpreted carefully, considering scope, Incoterms, tower supply, logistics, installation, and warranty conditions.

You can access the full report here

🐟 Ming Yang completes the third “harvest” of its offshore wind–aquaculture platform

Ming Yang has once again made headlines with its platform that combines an offshore wind turbine with aquaculture, announcing on its LinkedIn account that it has just completed the third commercial “harvest” season of the project.

The pilot installation has produced 20,000 kg of premium fish (golden pompano, grouper, and snapper) raised in multi-species cages equipped with an AI-controlled smart feeding system.

Interestingly, Mingyang is giving this concept both importance and international visibility. The company first introduced it through a sponsored article in Recharge and is now promoting it again on social media. It’s clear that Ming Yang wants to associate its brand with innovation and marine sustainability, even in unconventional forms.

If successful, this concept could become a bridge between the wind energy and fishing sectors, two worlds that have historically struggled to coexist.

A few years ago, Shanghai Electric also claimed to have installed the world’s first floating offshore wind turbine integrating solar PV and a fish-farming facility.

Thank you very much for reading Windletter and many thanks to Tetrace, RenerCycle and Nabrawind our main sponsors, for making it possible. If you liked it:

Give it a ❤️

Share it on WhatsApp with this link

And if you feel like it, recommend Windletter to help me grow 🚀

See you next time!

Disclaimer: The opinions presented in Windletter are mine and do not necessarily reflect the views of my employer.